unemployment income tax refund status

Submit an Estimated Payment. Use the NJ Refund Status link to go to the New Jersey State Income Tax Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information.

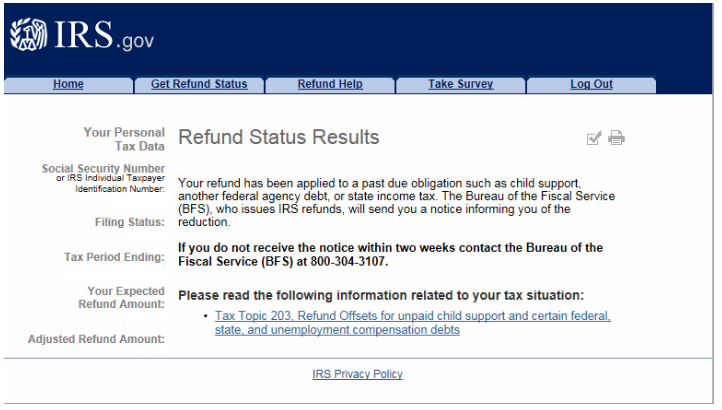

Wmr Says Code 203 That I Have An Offset But My Ddd Is 2 24 I Owe Unemployment For Overpayment When I Call Offset Number That Means I Wont Get My Money 2 24

Viewing your IRS account.

. You may check the status of your refund using self-service. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate. The IRS has sent 87 million unemployment compensation refunds so far.

File a premium federal tax return for. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. The unemployment tax refund is only for those filing individually.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. For the most up-to-date information on filing a tax return with unemployment income please visit our unemployment information page. Business income accounting records for any business that you own Unemployment income.

The unemployment benefits were given to workers whod been laid off as well as self. Unemployment Income and State Tax Returns. The 10200 is the amount of income exclusion for single filers not the.

Grey Owl by Zdenek Machácek. Resume a Personal Income Tax Return. If you use Account Services.

In the latest batch of refunds announced in November however the average was 1189. Using the IRS Wheres My Refund tool. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such.

File a Personal Income Tax Return. Extensions can be filed online only. However if as a result of the excluded unemployment compensation taxpayers are now.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Unemployment compensation is taxable income which needs to be reported by filing an. Account Services or Guest Services.

Income from local and state tax refunds from the prior year. There are two options to access your account information. To report unemployment compensation on your 2021 tax return.

Unemployment tax refund status. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. DMV Tax Certification for Driving Privilege Card.

Check the status of your refund through an online tax account. Most taxpayers need not take any action and there is no need to call the IRS.

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Guide To Unemployment And Taxes Turbotax Tax Tips Videos

Tax Refund Delay What To Do And Who To Contact Smartasset

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Report Unemployment Benefits Income On Your Tax Return

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Can The Irs Take Or Hold My Refund Yes H R Block

Unemployment Refunds Are Coming Everyone R Irs

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Tax Refund Offset Tax Topic 203

Irs Refund 2021 Will I Get An Unemployment Tax Check

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

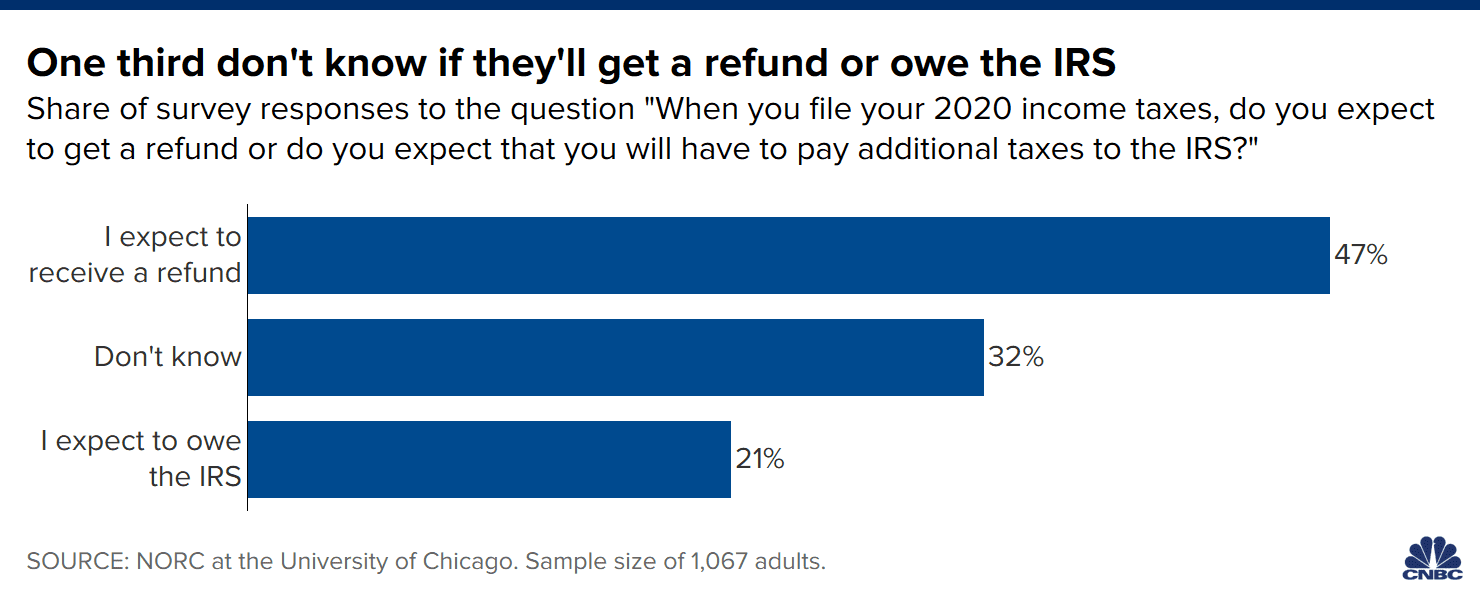

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Irs Tax Refund Delays Persist For Months For Some Americans Abc13 Houston